Our Faculty Members

Shasat takes great pride in its world-class faculty, consisting of over 35 highly qualified experts celebrated for their thought leadership across a broad spectrum of specializations. These professionals bring unmatched expertise in areas such as International Financial Reporting Standards (IFRS), International Public Sector Accounting Standards (IPSAS), Generally Accepted Accounting Principles (US GAAP), UK GAAP, ECL and CECL Modelling experts, risk management strategies, valuations, mergers and acquisitions, corporate governance, sustainability standards and regulations, supply chain management, prudential regulations, and critical compliance domains, including Basel regulations, Solvency II, Anti-Money Laundering (AML) regulations, and a range of other highly specialized areas requiring deep technical knowledge.

Our faculty’s capabilities extend beyond technical expertise, encompassing cutting-edge professional development programs like negotiation mastery, presentation excellence, data management, Python programming, blockchain technologies, digital assets, and Becker CPA. This ensures participants are equipped with contemporary skills tailored to the dynamic demands of modern industries.

With a depth of knowledge and practical experience, combined with a steadfast commitment to advancing intellectual growth, our faculty delivers highly impactful and engaging learning experiences. These programs are meticulously designed to address the needs of seasoned professionals and senior executives, focusing on real-world applicability to ensure actionable insights and enhanced knowledge retention. This is your opportunity to learn from globally recognized experts and industry leaders who have dedicated their careers to shaping and influencing best practices worldwide. Their profound insights, honed through years of experience, will enable you to refine your expertise, confront complex challenges, and excel in an ever-evolving professional environment.

Join us to unlock your full potential—broaden your perspective, sharpen your strategic edge, and elevate your professional growth to extraordinary heights. At Shasat, we empower you to thrive as a leader in your field.

Sunil Kansal

Sunil leads the Consulting and Valuation Division at Shasat Consulting, bringing over 28 years of extensive industry expertise across a diverse range of domains. His leadership encompasses financial structuring, implementations of IFRS, IPSAS, UK & US GAAP, market and credit risk hedging, valuations, sustainability standards implementation, regulatory compliance, and change management. Sunil’s distinguished career includes working with some of the world’s most prominent financial institutions, such as Bank of America, ING Group, and Nomura, as well as all of the Big Four accounting firms (KPMG, Deloitte, PwC, and EY) across multiple jurisdictions. His deep expertise in financial instruments, including insurance products, transaction structuring, and handling complex transactional challenges, has established him as a recognized authority in the field.

A prolific author and thought leader, Sunil has published numerous technical articles and books on key topics such as consolidation, de-recognition, leases, revenue recognition, measurement and risk hedging, impairment modeling (ECL & CECL), regulatory compliance, financial structuring, asset management, and other complex areas. His insights are highly sought after, and he is frequently invited to speak at prestigious conferences organized by Risk, Informa, AICPA, CIMA, ICAEW, Marcus Evans, and others.

Sunil is a Chartered Accountant and holds the distinguished Fellow status with the Institute of Chartered Accountants in England and Wales (ICAEW). Renowned for his expertise, strategic vision, and commitment to excellence, Sunil continues to shape best practices in consulting, valuation, and related fields, making a significant and lasting impact on the industry.

Michael Winkler

Michael is an actuarial expert and also a renowned speaker. He is currently leading Shasat’s actuarial desk and has been providing advisory services to reinsurance and insurance companies in the area of Financial Solutions, mainly focused on Solvency II and IFRS 17. Besides working on the actuarial models, he is supporting few major reinsurance companies on the specific impact of the IFRS 17 and potential measures mitigating adverse effects. He has also been nominated on the board of many international insurance companies. He has spent many years working for the life insurance and reinsurance firms. He was the Chief Actuary at Union Re and then Swiss Re. He was leading the international project group developing the first Spanish annuitant mortality tables in 2000 and was the author of the Swiss Re publication “To live and let pay. Longevity and pensions insurance in Europe”

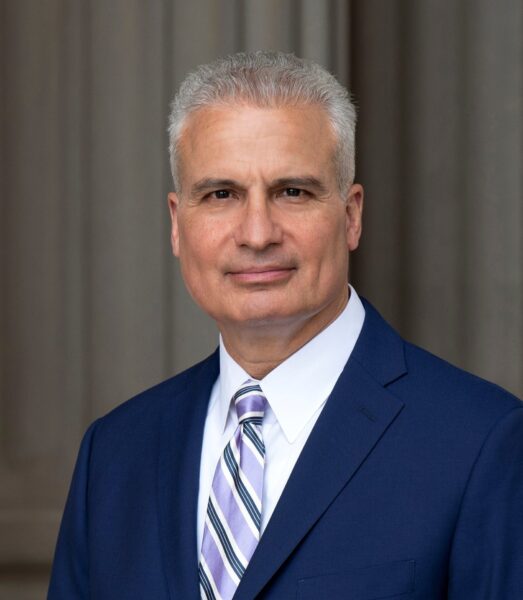

Charles W. Hester

Charles is a renowned US GAAS, US GAAP, and Public Sector Accounting specialist and also a speaker. He is a Certified Public Accountant (CPA) from the Arizona and California State Board of Accountancy. He has taught for the Government Audit Training Institute in Washington, DC, the Pacific Islands Training Institute in Honolulu, the California Association of State Auditors, the California Society of Accountants and various other accounting and auditing professional organizations. He is a member of various professional auditing and accounting organizations and has written several articles that have been published in professional journals. In California, he has served two 8-year terms as a member of the Qualifications Committee for the California Board of Accountancy and has again been appointed to the Committee. He has also served on the California State Bar’s Commission on Judicial Nominees Evaluation. In the past, he has served on the Disciplinary Board of the Oregon State Bar and the Oregon Boards of Geologists, Engineers, and Land Surveyors. Also, he served as the Receiver for the Bank of Micronesia in Palau.

Chris Boland

Chris Boland is a professional IFRS consultant and trainer specializing in assisting clients with their transition from local or US GAAP to International Financial Reporting Standards (IFRS) and the application and adoption of new IASB standards, such as IFRS 17 Insurance. Mr. Boland is a CPA, CA and CMA. Mr. Boland has extensive experience with IFRS, US GAAP, and corporate disclosure requirements. Prior to establishing his IFRS public practice and teaching practice, Mr. Boland was General Manager of Accounting and IFRS reporting at Canada Post Corporation. His prior positions at other public and private organizations included various CFO roles. Mr. Boland also has over 30 years of experience in numerous sectors.

Claire Dean, BSc, FCA

Claire Dean is an experienced speaker who has been delivering high energy, engaging and practical learning programs on IFRS, UK GAAP and the technical developments in these areas. Claire previously worked within Ernst & Young’s Financial Reporting Advisory team in London, providing technical advice and training to clients of EY. She has extensive training experience delivering public and in-house courses to corporates from a wide range of industries worldwide for over 15 years.

Alexandre Pinot

Alexandre Pinot, CAMS is a financial crime and AML compliance specialist with over eight years of experience across France, Germany, and Lithuania. He has developed deep expertise in global payments, international money transfers, and evolving AML/CTF regulatory frameworks. A founding member and co-chair of the ACAMS Baltics Chapter, Alexandre has been an active ACAMS member since 2013. As a sought-after speaker and trainer, he has delivered more than 400 AML/CTF onsite trainings for a wide range of institutions—from retail telecom points of sale to international banks—and regularly conducts internal compliance trainings.

Michael Bret Hood

He is an expert in the Anti-Money laundering regulations, risks, challenges and best practices adopted by organisations. After serving 25 years as a Special Agent in the FBI, Michael now shares his knowledge through learning & development programmes. During his tenure with the FBI, Bret worked on many complex financial crime, money laundering, corruption and major cases such as the 9/11 terrorist attack, the HealthSouth fraud, and the Maricopa Investments case. Bret is an ACFE faculty member and has published articles in both Fraud Magazine and ACAMS Today. Bret is also the author of the critically acclaimed books, Eat More Ice Cream: A Succinct Leadership Lesson for Each Week of the Year & amp; Get Off Your Horse! 52 Succinct Leadership Lessons from U.S. Presidents.

John Sitilides

John Sitilides is a geopolitical strategist specializing in U.S. government relations, geopolitical risk, and international affairs. He served as a U.S. State Department Diplomacy Consultant (2006-2023) under Presidents Biden, Trump, Obama, and Bush, managing professional development at the Foreign Service Institute. A National Security Senior Fellow at the Foreign Policy Research Institute, he advises corporate executives and investors on the economic and security implications of global geopolitical shifts. He was also Board Chairman of the Woodrow Wilson Center Southeast Europe Project. A well known speaker at corporate and government conferences, he is a frequent national security commentator on Bloomberg, CNN, FOX News, News Nation, and has been cited in leading publications such as The Wall Street Journal, The New York Times, The Washington Post, Politico, and The South China Morning Post.

Andrew Tenant

Andrew Tennant is a subject matter expert witness in the field of Money Laundering methodologies and typologies for the National Crime Agency, providing expert evidence in court cases. Providing guidance upon money laundering investigations, prosecutions and defence case preparation. He is also a member of the UKs and Eastern Caribbean’s advisory groups on crypto currency exploitation and regulation. Andrew has been in the law enforcement arena for over twenty-three years as a UK police officer, financial investigator, confiscatory and tutor. Andrew has worked through Europe in Greece, Poland, Albania and Bulgaria. In 2018 Andrew undertook to write the Eastern Caribbean’s Financial investigation programme and CPD, whilst based in Barbados. He has a successful track record in prosecutions around Money Laundering and fraud winning national awards in the field of criminal investigation, financial investigation and IP fraud. Presently working from Bermuda he offers specialist advice, guidance and training in respect of an international corruption and money laundering enquiry involving politically exposed persons. He also provides senior investigating officer support and guidance in respect of restraint, confiscation, investigation, disclosure and charge preparation. Andrew is a board member of both the Anti Money Laundering and Financial Crimes agency (AMLFC) based in Miami and the Institute of Financial Accountants based in the UK.

Feyzi Bagirov

Feyzi Bagirov is a Business Intelligence Analyst turned Data Scientist with over 12+ years of experience helping organizations use data and analytics for growth, transformation. He is currently a Data Science Advisor at Metadata.io, a B2B marketing automation start-up. Mr. Bagirov has also been teaching Analytics and Data Science in various graduate and undergraduate programs in the US and was a Founding Director of BS in Data Science at Becker College in Worcester, MA. He is a well-known speaker at various Analytical and Data Science Conferences and is a Top Writer on Quora on the topics of Data Science and Data Analytics. He holds an MBA from Babson College and is pursuing his doctoral studies in Data Sciences at Harrisburg University of Science and Technology.

Dr. Marinus de Pooter

Marinus has extensive international management, consulting and training experience in governance, risk management, compliance, control, audit and finance. In previous roles, he was Director of Finance at Ernst & Young Global Client Consulting, CFO of a business intelligence consulting firm and European Director Internal Audit at Office Depot. He also worked as Executive Director and ERM Solution Leader at EY Advisory. Marinus focuses on supporting entrepreneurs, directors and managers with keeping their organizations future-proof. He has developed an intuitive value management approach. It enables decision-makers to connect with experts for the sake of continuously creating and protecting what their core stakeholders’ value.